At Open Finance AI, we offer secure, fast, and scalable payment solutions tailored to your needs.

Open Finance AI empowers users with seamless, transparent, and accessible financial control.

Open Finance AI puts financial control in the hands of users, offering solutions that make banking more seamless, transparent, and accessible. By integrating PSD2, we lead the fintech sector, providing security, speed, and expanding payment possibilities. Our scalable platform serves both small businesses and large enterprises, ensuring your financial needs are always met in a personalized and efficient way.

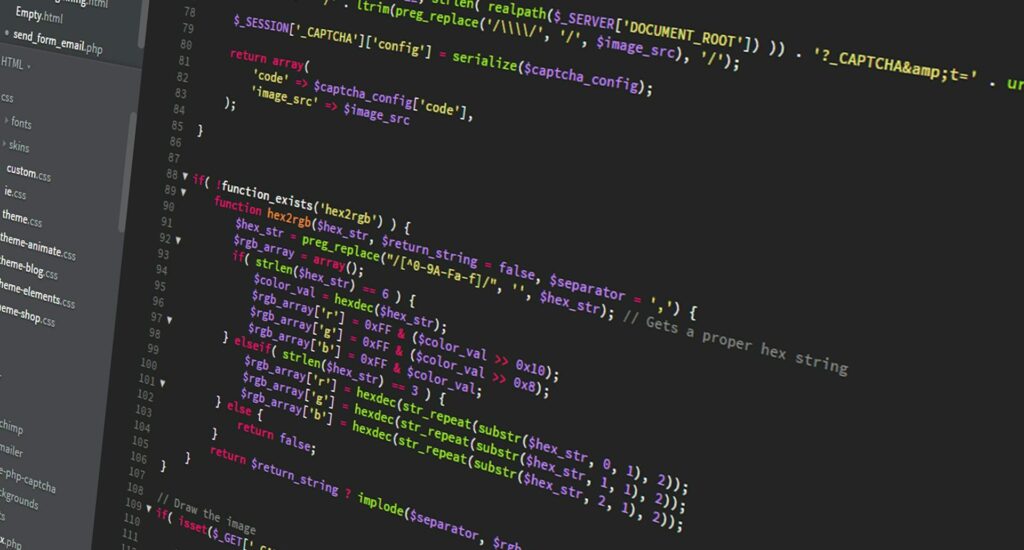

Just worry about the data, no effort to implement!

Derive meaning from your users’ raw data to turn it into decisions.

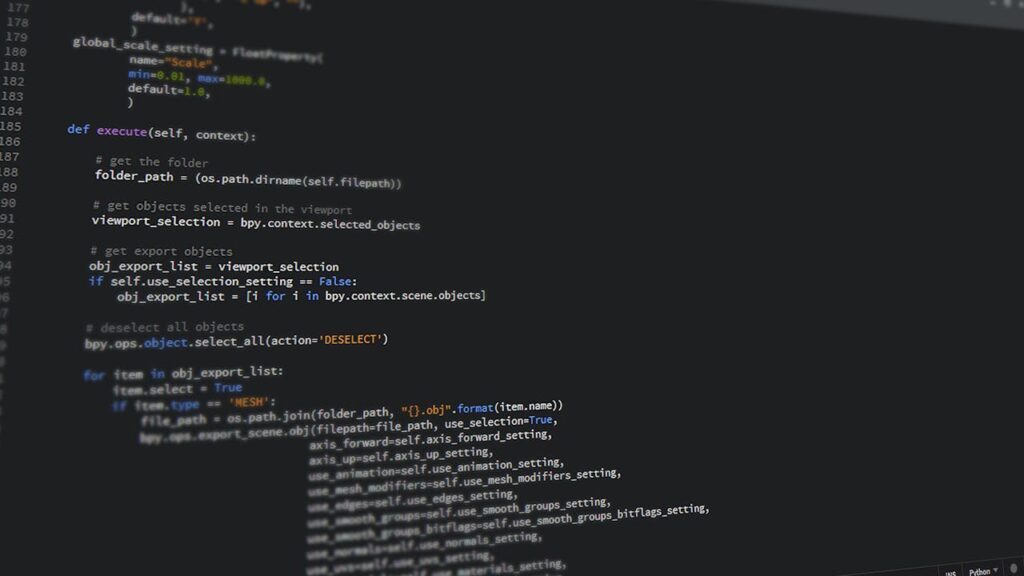

Automate billing your clients.

Connect to our API to create connections to your user accounts.

A simple and personalized experience for your users.

Offer an automated and personalized experience for your users.

Instant payments in your own app.

A customized plug and play solution for your users.

At Open Finance AI, we drive the transformation of financial services with innovative, secure solutions that enhance customer experiences and streamline digital payments.

Our platform scales to meet the financial needs of businesses of all sizes, integrating seamlessly while prioritizing security and compliance with regulations like PSD2 and Open Banking.

We offer Payment Initiation (PIS) and Account Information Services (AIS) to help clients navigate the evolving financial landscape, ensuring data protection and service excellence.

Discover how Open Finance AI can revolutionize your financial operations with secure, efficient solutions.

At Open Finance AI, we are dedicated to providing innovative solutions that align with key financial regulations, including the Payment Services Directive 2 (PSD2).

PSD2 is a European directive designed to enhance security, transparency, and competition in the payments sector. Enacted in January 2018, it empowers consumers by giving them more control over their bank accounts and fostering innovation between banks and fintechs.

PSD2 also mandates Strong Customer Authentication (SCA) to increase the security of online transactions through multi-factor authentication.

Open Finance AI leverages PSD2 to develop secure, efficient payment solutions, always prioritizing user experience.

Open Banking gives consumers secure access to their financial data, with their consent, allowing institutions like Open Finance AI to offer personalized services. By sharing data across institutions, it promotes competition and drives innovation, enabling better financial products like improved loan rates and convenient payment solutions.

Security is paramount in Open Banking. At Open Finance AI, we prioritize the protection of user data, ensuring privacy and integrity. We’re redefining the financial experience with solutions focused on innovation, security, and personalization.

An Account Information Service (AIS) is an online service that provides users with a consolidated view of one or more payment accounts they hold with different financial service providers. Companies authorized to provide account information services can, with the explicit consent of the consumer, access their bank accounts to offer new products and services.

To provide AIS, it is necessary to be registered or authorized by a competent regulatory authority. This is essential to benefit from the open access measures of PSD2, which requires payment service providers to grant access only to companies that are registered or authorized to offer AIS

Under PSD2, a Payment Initiation Service (PIS) is an online service that accesses a user’s payment account to initiate the transfer of funds on their behalf, with the user’s explicit consent and authentication.

Open Finance AI offers Payment Initiation services, enabling your users to make real-time payments without manually entering their account details or leaving your app. These in-app payments provide a seamless and secure way for your users to complete transactions, whether it’s to fund their accounts, make online payments, or pay invoices, all directly from your app or website.

If your business acts as a Third Party Provider (TPP) interacting with an Account Servicing Payment Service Provider (ASPSP), an eIDAS certificate is required for authentication. For example, when Open Finance AI connects to an ASPSP via Open Banking APIs, we present our eIDAS certificates to verify our identity.

As of January 17, 2020, the Financial Conduct Authority (FCA) allows ASPSPs to accept certificates issued by API program providers, provided they are issued only to TPPs registered with their eIDAS certificate. The API provider must also continuously verify the TPP’s eIDAS certificate status with the Qualified Trust Service Provider (QTSP).

Do you have any questions, suggestions, or would like to learn more about our payment and Open Banking solutions? Fill out the form below, and our team will get back to you as soon as possible. We are here to help transform your financial operations with innovation, security, and efficiency.